There’s been a lot of information about it, but if all IR35 still means to you so far is a vague recollection of a story involving Lorraine Kelly a couple of years ago and perhaps a series of radio and television presenters since then, you are in the right place to get brushed up on what’s happening in the world of HMRC and if this affects you.

Simply put, it’s a way for the Treasury to make more money through National Insurance contributions by clamping down on what HMRC considers to be ‘disguised employees’ and the reason that it might affect you is because as of the 6th April, if you are a medium to large business it’s your responsibility to ensure that any contractor you hire, including any existing ones, is catagorised correctly under the IR35 rules.

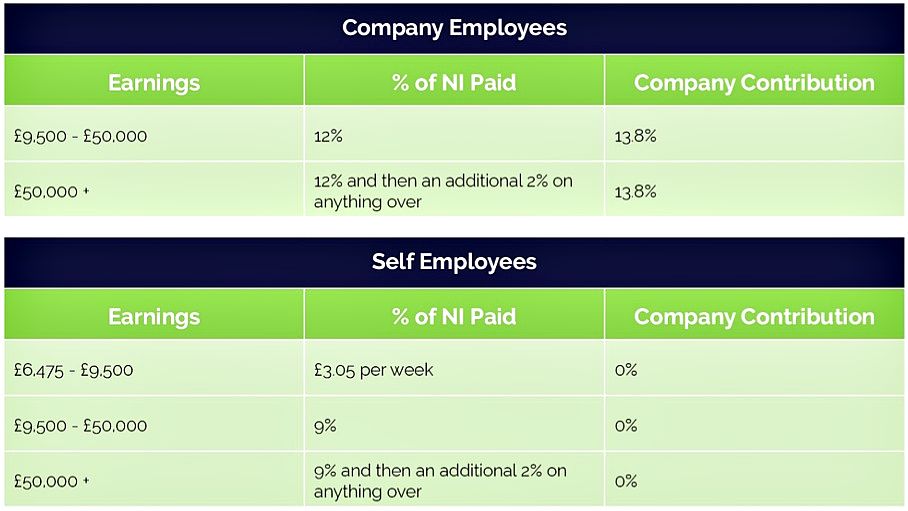

Historically being self employed comes with a benefit of tax efficiency for both you and the contractor as you can see in the table below however HMRC now view this as possible tax avoidance and IR35 seeks to rectify this as an employment status test for tax if you like, which works out whether a contract points towards employment or self-employment:

• if your contract is ‘inside IR35’, it points towards employment. HMRC sees your ‘contractor’ as an employee and you both pay National Insurance contributions like any other employee.

• if your contract is ‘outside IR35’, it points towards self-employment, and you can both carry on as you normally would.

It all boils down to whether your contractor “would be an employee if there was no intermediary” ie the contractor’s limited company or personal service company (PSC)

For some this has been a welcome change, in regulating what constitutes as ‘self-employed’ it’s prevented larger companies from taking advantage of their workforce; recently Uber have been forced to reclassify theirs, previously all drivers were ‘self-employed’ (but not actually driving for anyone else besides Uber), this change means that they are now entitled to a minimum wage and other statutory benefits like any other employee.

That said with Andy Chamberlain, Director of Policy at The Association of Independent Professionals and Self Employed (IPSE) reporting that this will slash self-employed income by up to 50% and in a time where the innovation and drive of independent business have been holding up the economy, it’s not been a popular move for everyone.

So what do you need to do?

You can use the Check Employment Status for Tax service to help you decide if the ‘Off payroll’ rules apply and determine the taxes that you and your contractor should be paying.

And if you’re concerned about making mistakes initially, HMRC reaffirmed earlier this year that they will be using a ‘light touch’ with regards to penalties for accidental errors within the first 12 months (providing that they do not suspect fraud or deliberate non-compliance) citing that they realise the burdens that this may place on businesses during an already turbulent time.

Not everyone is going to get it right first time, HMRC themselves have lost a lot of cases including those in their own domain, see Alcock Vs HMRC; an IT consultant working for the Department of Work and Pensions no less.

BUT if you’re still concerned then look no further than your friendly accountant (that’s us by the way!) to help you through, Accounting Clarkes, always here supporting YOU and your business.