At a time where every penny counts, it’s good to know about the Coronavirus Statutory Sick Pay Rebate Scheme; designed to reclaim some or all of the Statutory Sick Pay (SSP) paid to employees who are absent from work due to a Coronavirus-related absence.

Am I eligible?

If you had less than 250 employees across all your PAYE payroll schemes on 28 February 2020 and have paid sick pay to an employee who was absent from work as a result of a Coronavirus-related absence then the answer is yes. And it’s not restricted to those with COVID-19 symptoms either, the scheme also applies to employees who have been asked to shield or self-isolate.

Although SSP can be reclaimed for more than one period of absence, this is capped at 2 weeks per person overall.

An employee is eligible for SSP if:

- they are self-isolating because someone that they live with has Coronavirus symptoms or has tested positive for COVID-19;

- they have been told to isolate by the NHS or a public health body because they have been in contact with someone who has tested positive for COVID-19; or

- they have been notified by the NHS to self-isolate before surgery for up to 14-days.

Something to note is that whilst usually you would have 3 waiting days before SSP is paid, any absences due to coronavirus can be paid from the first day of sickness offering more support to those affected.

With regards to self-isolation, this can also be paid from the first day as long as the following criteria is met:

- it started on or after 13 March 2020 where someone they live with has Coronavirus symptoms or is self-isolating;

- it started on or after 28 May 2020 where the employee was notified by the NHS that have come into contact with someone who tested positive for Coronavirus; and

- it started on or after 26 August 2020 where the employee was notified by the NHS of the need to self-isolate prior to surgery – this will only cover the time prior to surgery and not the day it is performed or any following recovery days as it is no longer ‘coronavirus related’.

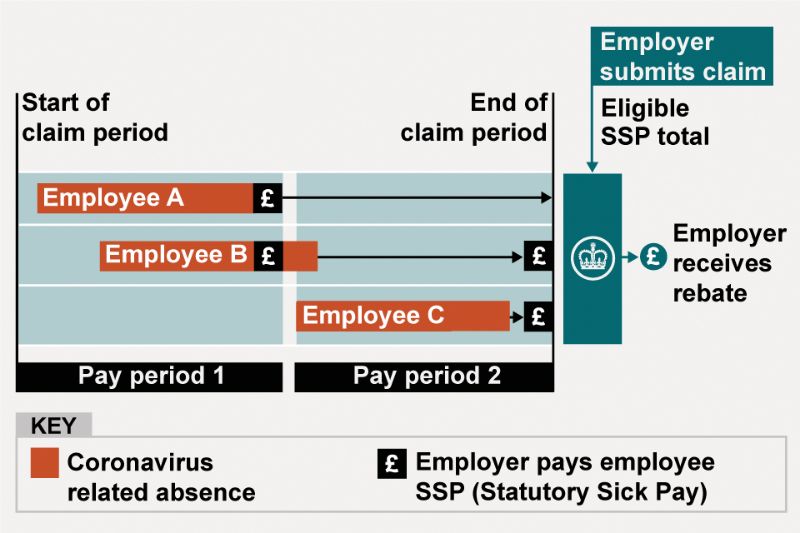

Image showing an employer claiming SSP for 3 employees over 2 pay periods. The claim starts on the first day of the first pay period, and ends on the last day of the second pay period. The claim amount is what’s paid to each employee capped at 2 weeks.

What you’ll need to make a claim

You’ll need:

- the number of employees you are claiming for

- start and end dates of your claim period

- the total amount of sick pay you’re claiming back – this should not exceed 2 weeks of the set SSP rate

- your Government Gateway user ID and password that you got when you registered for PAYE Online – if you do not have this find out how to get your lost user ID

- your employer PAYE reference number

- your UK bank or building society account details (only provide account details where a Bacs payment can be accepted)

Records you must keep

You must keep records of Statutory Sick Pay that you’ve paid and want to claim back from HMRC.

You must keep the following records for 3 years after the date you receive the payment for your claim:

- the dates the employee was off sick

- which of those dates were qualifying days

- the reason they said they were off work – if they had symptoms, someone they lived with had symptoms or they were shielding

- the employee’s National Insurance number

You can choose how you keep records of your employees’ sickness absence. HMRC may need to see these records if there’s a dispute over payment of SSP.

You’ll need to print or save your state aid declaration (from your claim summary) and keep this until 31 December 2024.

Claims can be made on the GOV.UK portal and should be paid within 6 days of submission.

We’re here supporting your business so please do lean on us if you have any questions about how to get the most out of your money and if you’re not a client yet, call 07796 954685 to book a free 30-minute discovery session to find out how we can help.